Many up-and-coming government contractors face the same conundrum: QuickBooks is the affordable go-to accounting software as they get their business off the ground. But what about Defense Contract Audit Agency (DCAA) compliance? Whether or not your budget can afford a fully integrated accounting system at the time, regulatory compliance is not an option.

The good news is that a proper project setup in QuickBooks can save you lots of compliance time and headaches. So not only can you meet DCAA obligations, but you set yourself up for an easier transition to more complex software in the future.

Three Steps to QuickBooks Customer Hierarchy

- Use QuickBooks’ customer hierarchy setups for correct recording of project information from the get-go. This can put you in good standing at audit time and allow a smoother conversion to a more robust accounting system later.

- Start with your main client—say, the Department of the Army or the U.S. Department of Transportation—as the overall customer. You can then add sub-customers under this parent customer for each contract.

- From there, you can add even more sub-customers under each contract setup for whatever granularity you need.

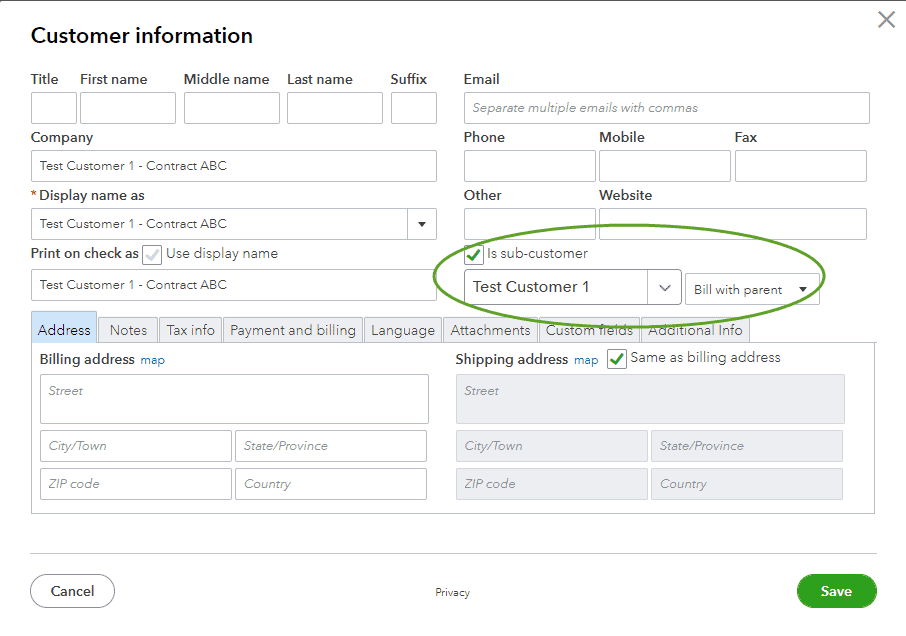

Make sure that when you set up sub-customers, you associate them as a sub-customer or project under a parent. Continue to follow this process for each level of granularity you need to capture the details you want to track.

For example, you can add even more sub-customers for contract line item numbers (CLINS) and accounting classification reference numbers (ACRNs). These classifications, dictated by the Federal Acquisition Regulation (FAR), often correspond with government accounting and funding specifications that may not line up with your own internal budgets but that is how the government needs the funding tracked. Sub-customer listings can help alleviate any confusion and make for a smoother DCAA auditing process.

Typically, when companies do not optimize their QuickBooks customer/project setup, they are left with poor reporting that reduces visibility into how individual projects are actually performing. You should also be coding all invoices and expenses (to include direct labor costs) to these specific project levels to ensure you get clean reporting.

The three-step process above will allow for more detailed reporting and easier audit compliance. When you’re ready to move to a project-focused accounting system such as Unanet, you will need to ensure that your data is cleanly organized by customer/project for an optimal conversion.

CAVU’s government accounting experts stand ready to help you optimize your QuickBooks setup and move you through a system upgrade when the time comes.