Crucial moments occur in the life of your GovCon business that demand credible and detailed projections about future performance. When this need arises, a contract waterfall is a must-have report. Unfortunately, it often gets undervalued as a strategic tool. A firm either skips the preparation of the report altogether or does not keep it up-to-date.

A contract waterfall is a standard expectation of potential buyers and investors. It arguably includes the most important information for the due diligence process. A contract waterfall is also highly desired by bankers, leadership teams, board members, and others who seek detailed information that reveals the true risks and opportunities of a business. This in-depth report of your contract pipeline will estimate revenue and costs at a level allowing for margin analysis.

Read on to understand how a contract waterfall provides clarity on your GovCon’s performance in the government marketplace.

What is a Contract Waterfall?

The waterfall report lays out a time-phased depiction of your signed contracts, with options and estimates of new business in the pipeline. This new business may include follow-on work, recompete business, and new procurements in your pipeline. A contract waterfall:

- Provides GovCon executives with visibility into sources of business.

- Generates a rapid understanding of the risk levels and timing that are crucial to hitting current and future year results.

- Most importantly, the report displays the revenue, profit, and margin outlook for the next 3-7 years. As contracts run out, revenue drops off, creating the “waterfall” in the title.

The waterfall chart generally provides the following contract information:

- Contract Status – This includes the source for contract estimates (active contracts with options, follow on, recompete business, or pipeline forecasts):

- Active contracts: These constitute your existing backlog divided into two groups.

- Funded backlog, which means your agency client has issued a funding document that guarantees how much you will be paid for the work you perform.

- Unfunded backlog, which means the agency has authorized, but not yet funded, the work.

- Active contracts: These constitute your existing backlog divided into two groups.

- Option Years: These are the out-year options for the continuation of work on awarded contracts. Option years are often not yet exercised and funded. Because their probability of issuance may be less than 100%, they can be assigned an individual pWin for inclusion in the waterfall.

- Recompetes: These are projections of new business that you expect to be awarded based on the recompetition of active contracts. As the incumbent, your firm may have a high probability of winning these recompetes because you have the advantage of past performance qualifications.

- New business: These are the awards you anticipate you can bring in over a given timeline. They are not a result of recompetes of active contracts. New business consists of several elements:

- Your identified pipeline, which contains the business you expect to be awarded from your current bid-and-proposal pipeline.

- Follow-on business, which you can include in the identified pipeline or break out as a separate category. Follow-on occurs when there is an expectation that existing clients will continue to expand and fund more work without a formal solicitation.

- Your unidentified pipeline—the contracts that you intend to pursue in the future—also represents part of your growth opportunities.

- Prime or Subcontract – Identifies whether your company is the Prime or Sub on contracted work.

- Type – Identifies whether the contract is unrestricted or full and open (F&O), small business, 8(a), or other relevant set-aside designations.

- Fee Type – Specifies the contract type, such as cost plus (CPFF, CPAF), time and material (T&M), or Fixed Price (FP).

- Customer – Names the agency supported by the contract. If it is a subcontract, the customer may include the prime’s name along with the agency supported.

- Start and End Dates – Sync with the time-phased numbers in the chart. If contract work has just begun, there may be a ramp-up. This category can also help to assess the impact of any delays.

- Contract Value, Funded Value, and Option Value – These numbers specify funded and unfunded work and break out option values based on option years.

- Cumulative to Date Spent – Including this amount with the “as of” date allows for the calculation of backlog amounts.

- Backlog – Funded backlog and unfunded backlog are included in the amount available to be used on the waterfall report.

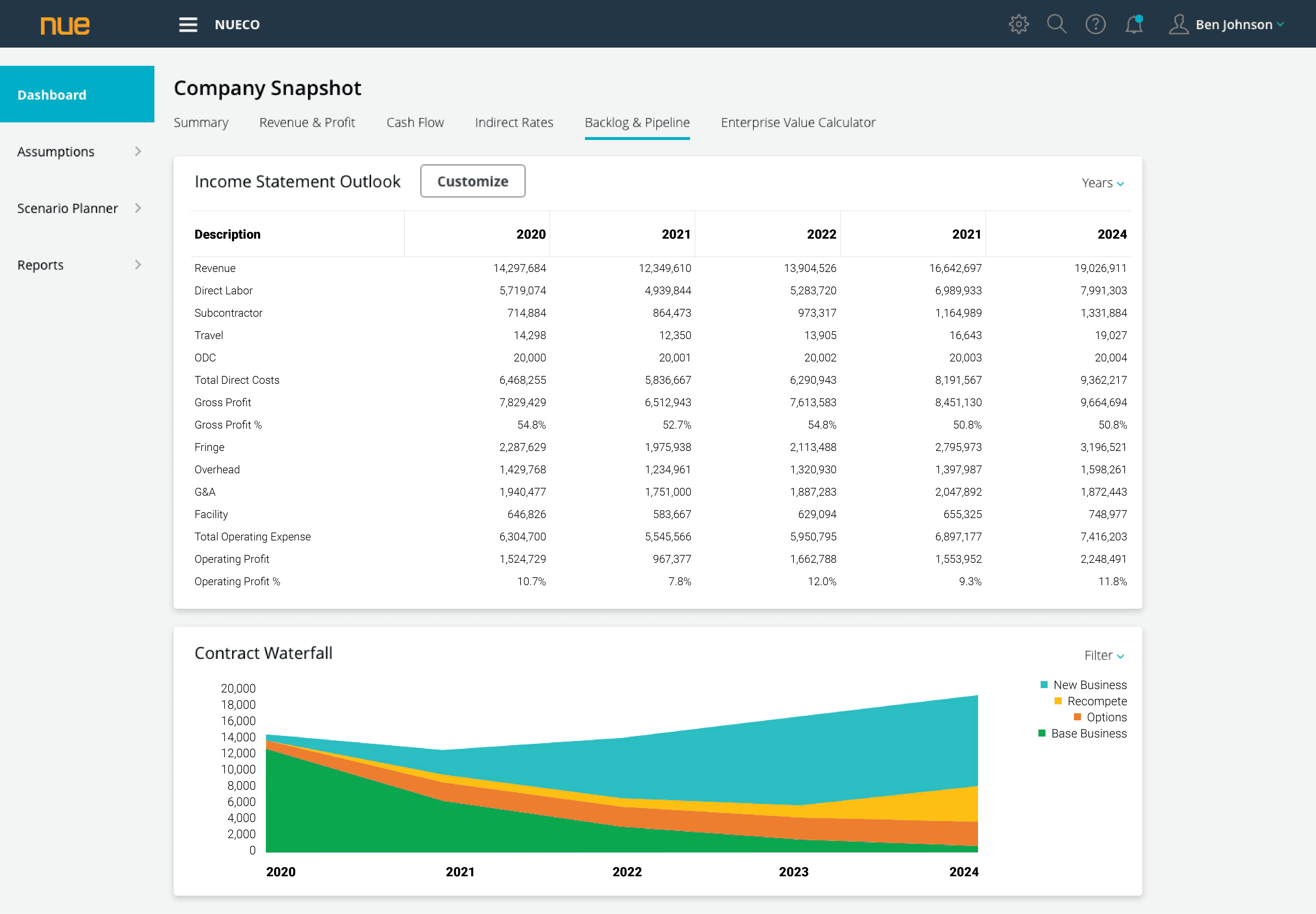

Below is a sample of a waterfall report with one year of detail for the multi-year time horizon. There is also typically a monthly (or accounting period) view for the most recent 1-2 years.

It is helpful to have a data visualization of your waterfall report (see examples below). This provides instant clarity into how fast existing business will be consumed as well as the magnitude of pipeline and other sources of new business required to achieve your targets. While the data visualization is not a replacement for the waterfall report, it provides decision-makers with a quick-glance perspective that helps them see where to drill down.

Dive Deeper, Act Accordingly

The detailed elements that support your waterfall summary chart can provide critical insights into the stability and strength of the current revenue stream and red flags that signal necessary shifts in contract strategy. Here are just a few examples:

- Contract & customer concentration risks – The fewer the number of contracts you rely on to achieve revenue projections, the greater the risk that a glitch will throw you off your financial goal. The lack of a diversified customer base similarly increases the risk that one adverse event will have a significant adverse impact on your revenue/profit stream.

- Prime contractor vs. subcontractor – As a subcontractor, you exercise less control over future financial performance. Your prime may choose another sub, decide to perform the work previously assigned to you, or issue funding in short-term increments.

- Timing – Active contract revenue projections should not extend past period-of-performance endings. The length of your remaining backlog is a contributor to stability.

- Probability of win – Are your pipeline projections dependent on a large number of low pWin opportunities? Or conversely, is there a large pipeline with high pWins. That’s a financial castle made of sand.

Keep It Updated

We see companies go through the meticulous process of preparing a waterfall report only to have it become stale due to the time and energy required for updates. Don’t let this happen to you. Tie your reporting to your information systems and allow for a more rapid refresh, so you spend more time strategizing with this critical information than re-creating it!

CAVU has the expertise to set you up with contract waterfall templates that extract data from your existing financial system to provide:

- A contract waterfall summary, updated monthly.

- Drill-down detail by project from backlog and pipeline data.

- Actuals that tie to your financial system to provide an integrated outlook.

Contact us today to start taking advantage of these competitive insights.